Is Professional Liability Insurance Claims-Made Or Occurrence: A Comprehensive Guide

Claims Occurrence Vs Claims Made

Keywords searched by users: Is professional liability insurance claims made or occurrence claims-made vs occurrence malpractice insurance, claims-made policy vs occurrence examples, claims-made vs occurrence tail coverage, switching from claims-made to occurrence, claims-made policy tail coverage, claims-made policy retroactive date, occurrence insurance example, is auto insurance claims-made or occurrence

What Is The Difference Between Occurrence And Claims-Made Professional Liability?

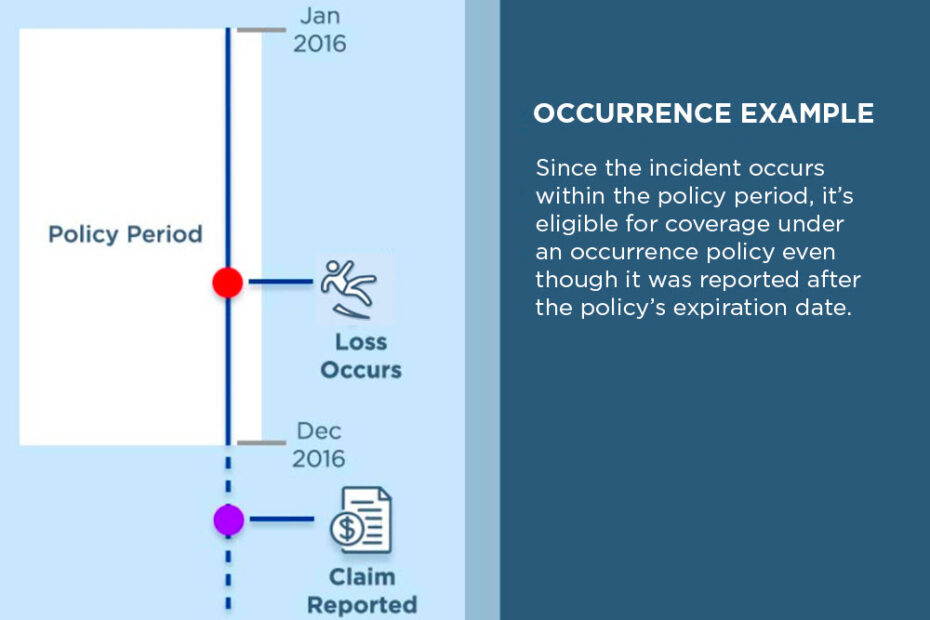

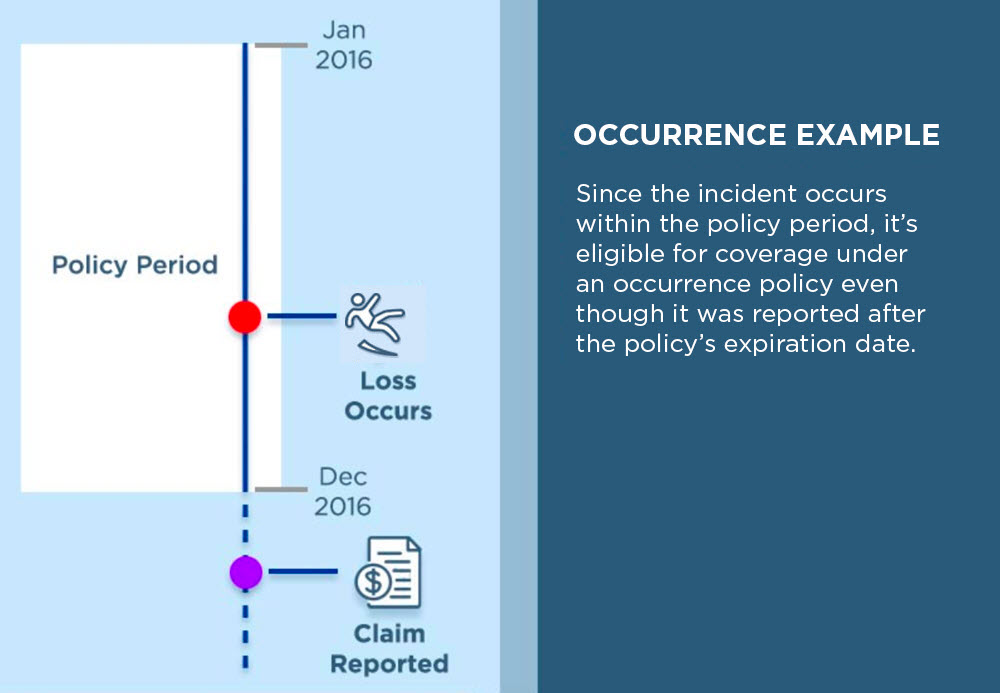

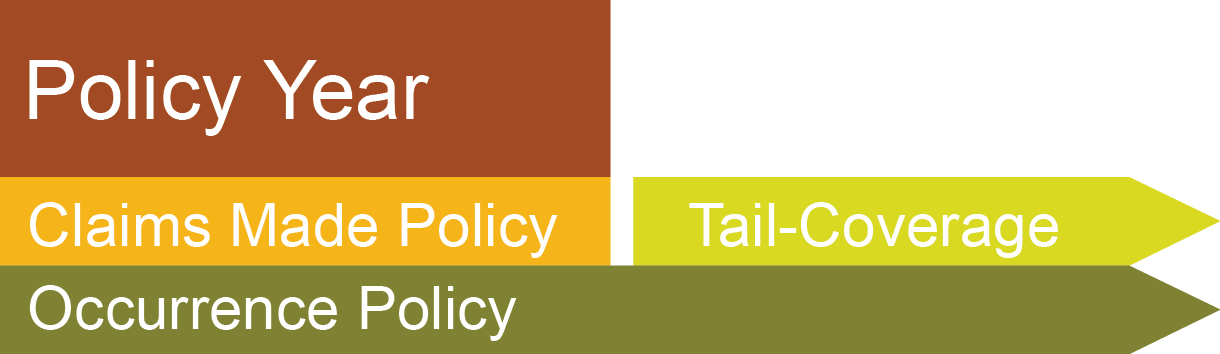

Understanding the distinction between occurrence and claims-made professional liability insurance is essential for ensuring comprehensive coverage. An occurrence policy provides continuous protection for any incidents that take place during the policy period, regardless of when a claim is filed. On the other hand, a claims-made policy offers coverage only for incidents that both happen and are reported within the policy’s defined timeframe. If you want coverage beyond the policy’s expiration date, you can purchase a ‘tail’ extension. This extension ensures that claims can still be made for incidents that occurred during the policy period but were reported after it ended. This distinction is crucial when selecting the right professional liability insurance policy to meet your specific needs.

What Is Professional Liability Insurance Claims-Made Basis?

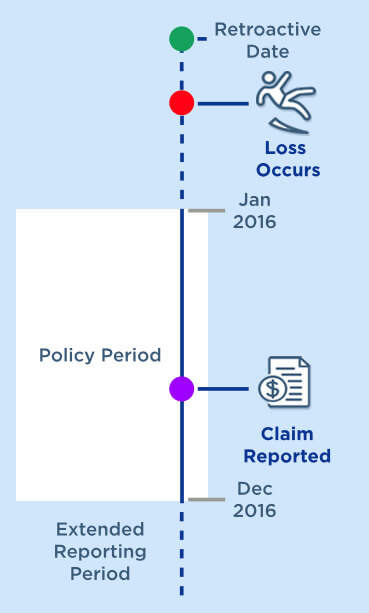

Professional liability insurance on a claims-made basis is a specific type of coverage that operates differently from typical insurance policies. In this setup, your policy covers claims that are made and reported during the policy year, which means it protects you only if a claim is made while the policy is active.

However, there’s a crucial element to consider: the retroactive date. This date signifies a point in the past when your coverage begins, and it enables you to add protection for claims related to incidents that occurred after this retroactive date. This process of extending coverage for events that happened in prior years is referred to as “prior acts” coverage.

In summary, professional liability insurance on a claims-made basis not only covers claims made during the current policy year but also allows you to include protection for incidents that occurred after a specified retroactive date, ensuring comprehensive coverage for your professional activities.

Is Professional Indemnity A Claims-Made Policy?

Is professional indemnity insurance a claims-made policy? To answer this question, it’s crucial to understand the concept of a “claims-made and notified” basis often used in Professional Indemnity policies. This policy structure means that a claim will be covered by the insurance policy that is in place when the claim is initially reported or notified to the insurance provider. It is essential to emphasize the importance of promptly reporting claims as soon as you become aware of them. For instance, if you discover a potential claim on April 15, 2022, it should be promptly reported to your insurer to ensure it falls within the coverage provided by the policy in effect at that time. This “claims-made” approach differs from other insurance structures, such as “occurrence-based” policies, where the policy in place at the time the incident occurred covers the claim, regardless of when the claim is made. Therefore, understanding whether professional indemnity insurance follows a claims-made policy is crucial for businesses and professionals seeking appropriate coverage.

Aggregate 44 Is professional liability insurance claims made or occurrence

Categories: Summary 51 Is Professional Liability Insurance Claims Made Or Occurrence

See more here: future-user.com

For example, general liability insurance is mostly available as an occurrence policy, while professional liability insurance, errors and omissions (E&O) insurance, and directors and officers (D&O) insurance mainly have claims-made coverage.An occurrence policy offers lifetime coverage for incidents that occur during the policy period, regardless of when the claim is reported. A claims-made policy only covers incidents that occur and are reported within the policy’s time frame unless a ‘tail’ extension is purchased.A claims-made policy covers you for claims-made during that one policy year. The retroactive date allows you to also add coverage for incidents that happen after your retroactive date. The process of covering those past years is called prior acts.

Learn more about the topic Is professional liability insurance claims made or occurrence.

- Occurrence vs. Claims-Made Insurance: Why It Matters

- What’s the Difference Between Occurrence & Claims-Made …

- Professional Liability – Claims-Made vs. Occurrence | The Trust

- What happens when a Professional Indemnity Claim is made?

- What Does Per-Occurrence Limit Mean in Business Insurance?

- D&O Insurance Vs. Professional Indemnity Insurance – BimaKavach

See more: https://rausachgiasi.com/your-money blog