Which Federal Consumer Credit Law Governs Credit Term Advertising?

Federal Laws And Agencies: Module 3 Of 5

Keywords searched by users: Which federal consumer credit law regulates the advertising of credit terms the borrower’s financial ability to meet credit obligations is called:, which federal consumer credit law prohibits credit card issuers from sending unrequested cards?, which federal credit law protects you against an unauthorized use of your credit card?, which consumer credit law prohibits abusive, deceptive, and unfair practices by debt collectors?, which federal consumer credit law starts all credit applicants off on the same footing?, a term that refers to the borrower’s assets or net worth is called:, which one of the following is not a source that provides data to credit bureaus?, which federal credit law sets the procedure for promptly correcting billing mistakes?

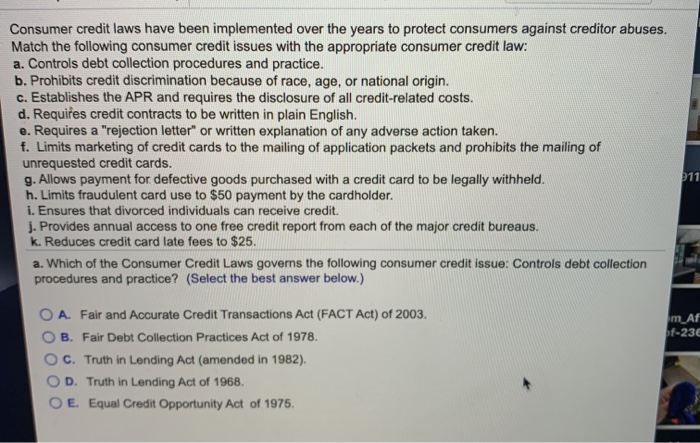

What Is The Federal Consumer Credit Protection Act?

The Federal Consumer Credit Protection Act, specifically outlined in Title VI of the Consumer Credit Protection Act, serves as a vital legal framework safeguarding sensitive information managed by consumer reporting agencies. These agencies encompass entities like credit bureaus, medical information companies, and tenant screening services. Under this act, the data contained within a consumer report is strictly regulated. It is prohibited from being disclosed to individuals or entities without a clearly defined and lawful purpose as stipulated in the Act. This legislative measure ensures that personal financial and medical information is handled with utmost care and confidentiality, offering crucial protections for consumers’ privacy and security.

Which Federal Consumer Credit Law Provides Specific Cost Disclosure Requirements For The Annual Percentage Rate And The Finance Charge As A Dollar Amount?

The federal consumer credit law that mandates specific cost disclosure requirements for both the annual percentage rate (APR) and the finance charge as a dollar amount is known as the Truth in Lending Act (TILA). This law enforces the disclosure of the finance charge, which represents the cost of consumer credit expressed in monetary terms. In essence, TILA ensures that consumers receive clear and transparent information about the financial aspects of their credit agreements, allowing them to make informed decisions regarding borrowing.

Details 18 Which federal consumer credit law regulates the advertising of credit terms

:max_bytes(150000):strip_icc()/Personally-identifiable-information-pii_final-f413d282a7b74142b147720a77811659.png)

Categories: Aggregate 98 Which Federal Consumer Credit Law Regulates The Advertising Of Credit Terms

See more here: future-user.com

Learn more about the topic Which federal consumer credit law regulates the advertising of credit terms.

- Personal Finance Flashcards

- Fair Credit Reporting Act | Federal Trade Commission

- Report to the Congress Finance Charges for Consumer Credit under …

- How the Fair Credit Reporting Act (FCRA) Protects Consumer Rights

- What Is The Consumer Credit Protection Act? – Forbes Advisor

- Lesson 18: Consumer Credit Protection Flashcards | Quizlet

See more: future-user.com/your-money